Retail

Scan, Pay, Leave

How a London-based Startup is Helping Retailers Fight Back Against Amazon

The Amazon Go store may have been celebrated by shoppers when it was revealed earlier this year, but for brick-and-mortar retailers it looked an awful lot like another nail in their coffin. To find out how retailers are fighting back Daniel Davies spoke to Mustafa Khanwala, CEO and co-founder of MishiPay, the startup that could soon allow retailers to take what ecommerce does well and combine it with their own traditional models

You’re standing at the back of a seemingly endless queue in the supermarket. You have one thing to buy, whereas everybody else has trolleys and baskets laden with items. The options before you are pretty simple: you can either stand there, like a good little kid, or push in further forward like that one person everyone hates, or you could just give up and storm out of the store without whatever it was you came to grab.

Getting rid of queuing, or at least alleviating it, has long been on the to-do lists of brick-and-mortar shops, but the launch of the Amazon Go store, which uses cameras to monitor and charge for customers’ purchases, earlier this year has surely moved that concern to the very top of their lists. After all, if retailers made the mistake of not caring when Amazon entered ecommerce; they sure care that Amazon may now aspire to move into brick-and-mortar retailing.

Solving retailers’ queuing problem is what led to the creation of MishiPay, a London startup that uses radio-frequency identification (RFID) to let shoppers pay for products in store using their mobile phones and promises to put an end to queuing.

As MishiPay’s CEO and co-founder Mustafa Khanwala explains, when his eureka moment struck, and he came up with idea to fuse the convenience of ecommerce with the benefits of actually being in a store, he was just a man, stuck at the back of queue, waiting to buy something.

“I was in Lidl, Tottenham Hale (London),” says Khanwala. “I used to not say the name of the supermarket, but I recently spoke to the Lidl Group, and they said no, no please mention it; we have no problem. So yeah, it is true, but the thing is I don't know if it was a Coke or a Red Bull, but it was one of those, and I waited 20 minutes.”

“I knew that RFID was being used in libraries for security, and I thought surely you could bring that into retail, and that just got me thinking: wouldn't it be amazing if we could just scan, pay and leave with our phone and then the security part would be covered by RFID?”

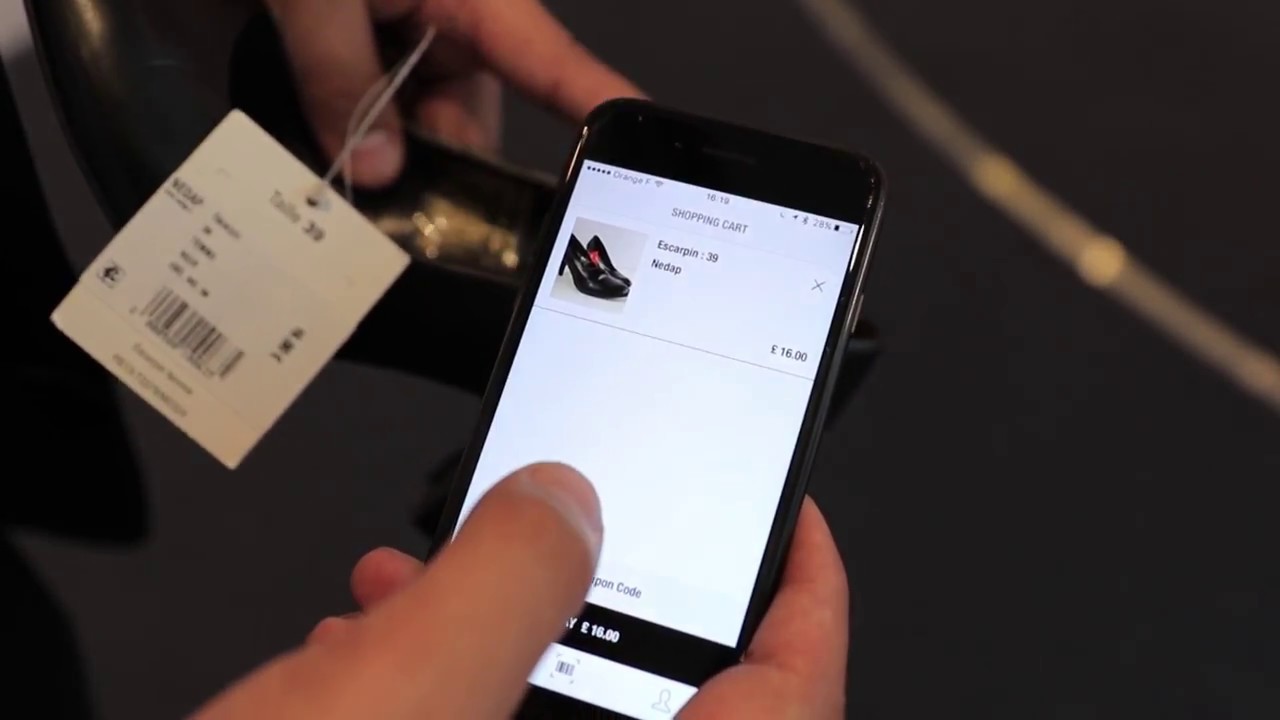

MishiPay: beating the queues with a scan and pay option

What Khanwala came up with was MishiPay, a startup that provides shoppers with a quick scan and pay alternative to queuing.

The technology essentially works like this: a paper-thin chip as is put on or in the product – in an item of clothing, for example, this could be embedded within the tag. Using MishiPay or the retailer’s own app customers scan the item, pay for it and leave the store. Because each and every chip in the world is unique, retailers know which chip has been detected and therefore whether it has been paid for or not.

Scan, pay, leave; just as Khanwala first imagined.

Although the premise that powers MishiPay is a simple one, getting retailers to understand the benefits of such a system is anything but. Even one of Khanwala’s early confidants confessed that the idea might be too big, and the problem too complex to convince the notoriously risk-averse retail industry of the technology’s promise.

“MishiPay provides the stores with the mobile technology, RFID tags, the security gates and payment gateways if retailers don’t already have these things in place.”

Ultimately, though, what MishiPay offers is more than just a novel technology; it’s a complete payment package that will allow brick-and-mortar stores to take on online retailers (not mentioning any, ahem, names) because MishiPay provides the stores with the mobile technology, RFID tags, the security gates and payment gateways if retailers don’t already have these things in place.

“We work with Avery Denison who are one of the largest label providers in the world, they're certainly one of the largest RFID providers,” says Khanwala. “They do the tagging. We work with gate providers; they provide the gates at the entry and exit to the retailer. We work with payment gateways... to make sure the money goes into the retailer’s account.

“We do the integrations with the different parts of the retailer’s product: promotion, payment, sales audit and security systems; and we synchronise this together on the front end for the shopper, so that when they scan we can allow them to pay and leave instantly. We disable the security, update the retailer’s system to make sure the transaction is logged and their inventory is updated. We bring in any promotions and make sure the correct prices show up.”

Image courtesy of MishiPay

The future looks good for retail; not so good for cashiers

MishiPay could completely change what we currently expect from a retail shopping experience, and it would certainly be a positive change for the customers. But what about the people who work in these stores? MishiPay’s success could mean employees’ roles are changed or eradicated altogether.

With queue-less shopping there is no need for cashiers, so the sole responsibility of retail staff will be to provide advice, expertise and help to customers who need it. This does mean that some staff may not be required in the MishiPay-powered stores of the future, which is something Khanwala is sanguine about.

“Productivity of staff is very important for a retailer,” says Khanwala. “If you're staff is stuck behind the till they're not very productive. You instead want to have them on the floor where they can do much more important things: selling, talking to people, helping them with things that they want.

“At least, that's what we advocate. Now what the retailers do is up to them, but the second point is, yes, even if it causes a little bit of unemployment, say 10% [or] 20%, that's at least better than the whole company being wiped out,” explains Khanwala.

“Consider a scenario like a BHS where the whole company is gone because they just weren't able to compete with the new 21st Century retail market. If we bring them into the 21st Century they might have to lose a little bit, prune off a little staff, but they at least keep the major share of them.”

“What these major companies see in MishiPay is not just an opportunity to provide customers with a better experience, but also a chance to remove a barrier that stops hesitant browsers from becoming customers.”

Even though this vision of a cashier cull is scary for employees, it certainly doesn’t seem to be putting off retailers. MishiPay already has piloted its technology with some of the biggest retailers in Western Europe, such as Leroy Merlin, one of France’s biggest DIY operators, and MediaMarktSaturn, the largest consumer electronics retailer in Europe.

What these major companies see in MishiPay is not just an opportunity to provide customers with a better experience, but also a chance to remove a barrier that stops hesitant browsers from becoming customers.

“The part of the journey where the shopper is most happy to part with their money is when they pick up an item and they make a decision that 'I want to buy this',” says Khanwala. “The more you delay this feeling from the actual moment of purchase, the less and less likely the shopper is to buy their item, and that's what is happening today.

“The moment you want to buy it, you look out for a till, you walk there, you wait in a line, then you go pay for it. With MishiPay the moment you want to buy it, 15 seconds later it's yours, no matter where you are within the store, no matter how many people there are within the store, so anywhere, anytime you can just do it.”

The Amazon Go spectre

Khanwala’s scan, pay, leave prophecy actually predates the opening of the Amazon Go store (which was launched to Amazon staff in 2016) but don’t for a second think that the awe Amazon’s project has garnered hasn’t encouraged the rest of the retail industry to move forward with their own plans.

“You know since Amazon Go launched at the end of 2016...people have, or at least retailers have, become a lot more aware of this issue than before,” says Khanwala. “They've got a lot more urgency in them now for actually making sure they change this part of themselves – you know, the checkout experience – because as they see Amazon coming into physical retail this is a big alarm signal for them, knowing when Amazon came into online they ignored them and now that Amazon is coming into the physical they don't want to ignore them, they want to say: ’what do we have to compete with this?’”

Amazon Go’s store uses hundreds of cameras and deep learning to identify when customers have taken products off the shelves and put them into their bags. While, according to Recode, Amazon has plans to roll this technology out in as many as six more of these stores this year, the system wouldn’t work for many high street retailers. The expense and logistics of installing hundreds of cameras in stores would be too much for many retailers, so for them MishiPay presents an alternative, working as it does with store’s existing systems and infrastructure while still allowing them to innovate.

“Regardless of how far and wide Amazon Go’s stores spread, Khanwala doesn’t see Amazon being in the brick-and-mortar retail market as necessarily a bad thing.”

Rather than being in direct competition with Amazon, MishiPay is supporting companies who themselves are or will be in direct competition with Amazon. But regardless of how far and wide Amazon Go’s stores spread, Khanwala doesn’t see Amazon being in the brick-and-mortar retail market as necessarily a bad thing.

“It's validating the need for such a solution,” says Khanwala. “I don't think that is the way for other retailers even if it works for Amazon, so to be honest, whether it's successful for Amazon or not is not really going to impact our value proposition.

“If it's not successful it's good for us because it further validates [our approach] and we can say this way does not work, but look at the number of users who really wanted to use it and look at the number of people who were excited about it, clearly something has to be done. If it is successful it's also validating the point that ok people want to keep using it. It’s working for them, we better find a way to compete with this.”

Amazon's Seattle-based Amazon Go store during its grand opening in January.

Image courtesy of VDB Photos / Shutterstock.com

Data insights and saving the high street

MishiPay promises that retailers will see the benefits of its technology in both their bottom lines and in customers’ satisfaction and experience ratings, but the startup also offers retailers another significant advantage: data insights.

Until now data insights have really been the preserve of online retailers, who glean knowledge from shoppers’ behaviours and use the information to offer the right products to the right customers. With MishiPay, this kind of sales strategy will also be available to brick-and-mortar retailers.

“Today if I have a loyalty card for the retailer, then the retailer knows who I am and what I've paid for at a maximum, but we will be able to go to the point of data of what was I thinking of buying and why,” says Khanwala.

“With more and more big-name stores seemingly teetering on the brink of collapse, the time has never been better for a solution like MishiPay to enter the market and provide retailers with a platform to move to experience-based shopping.”

“So say I scan a shirt and some pants, and I remove the pants from my cart. Today you have no idea I was interested in the pants, but with MishiPay we'll be able to answer ‘why did I do that?’ Did I do that because I never let my cart go over £100 and I had a cart over £100, or did I do that because I signed into the app with Facebook and I'm on a diet, so right now I'm not buying any pants. It's very similar to Amazon when you know you're just browsing and then you go to Facebook and you see them advertising something similar to you.”

With more and more big-name stores seemingly teetering on the brink of collapse, the time has never been better for a solution like MishiPay to enter the market and provide retailers with a platform to move to experience-based shopping. So does MishiPay see itself as the saviour of the high street? Not alone.

“There won't be just one factor to be honest. It's a twenty trillion dollar market; I won't presume to think that anyone, even an Apple-sized company or an Amazon-sized company, can be alone the saviour. Actually, Amazon is in some ways a destroyer,” says Khanwala. “We can definitely aspire to be [a saviour] for sure, and that is the aspiration. We think it is us, several of our partners and the ecosystem that [we] will develop together that will be the saviour.”